Sole Proprietorship

Sole Proprietorship - A Smart Option for Women Entrepreneurs

A sole proprietorship is a basic legal structure that gives your business recognition under the law. It’s easy to set up, and business taxes are filed with your personal tax return. However, the liability is unlimited, meaning creditors can recover dues from your personal assets if the business can’t pay them.

If you're a woman planning to launch a small or home-based business, a sole proprietorship is one of the most practical and empowering ways to get started. It’s simple, low-cost, and gives you full control of your business—making it especially attractive for women looking to formalize their ventures without excessive red tape.

Why Sole Proprietorship Works Well for Women

For many women in Pakistan juggling home, family, and income-generating work, a sole proprietorship offers:

- Full autonomy to make decisions

- Minimal startup costs

- Simple compliance requirements

- Eligibility for business loans and tax benefits

- Ability to run operations from home or online

Whether you're freelancing, baking, selling clothing, offering beauty services, or tutoring students, this model works.

Sole Proprietorship - How to register?

Setting up a sole proprietorship is straightforward. Though you can do it yourself, hiring a tax consultant or lawyer to handle it professionally is quick and inexpensive.

Here are the steps:

• Step 1: Decide on and Select a Business Name

Choose a name that reflects your brand. There’s no formal name reservation process for sole proprietorships, but uniqueness is still important.

Mini Scenario: Ayesha wants to launch a handmade jewelry line from home. She names her business “Bijou by Ayesha” and searches online to make sure the name isn’t already in use.

• Step 2: Design Letterheads and Business Cards

Print letterheads, visiting cards, and envelopes with your business name. These will help establish your identity and are needed for the next steps.

Mini Scenario: Zara, starting a freelance content writing service, designs simple letterheads and prints business cards using free online tools like Canva.

• Step 3: Open a Business Bank Account

Write an account opening request addressed to your preferred bank. In the letter, declare that you are the sole proprietor of your business.

Visit a nearby bank branch and submit:

- Your CNIC

- A letterhead or business card

- Application for a current account in your business’s name

Ask the bank to issue a certificate confirming your business account.

Mini Scenario: Hina starts a home-based beauty salon. She opens a current account under “Glow Room by Hina” and obtains the bank certificate needed for tax registration.

• Step 4: Register with the Federal Board of Revenue (FBR)

Visit the Federal Board of Revenue (FBR)’s online portal called Integrated Risk Information System (IRIS) to register your business.

- Use your CNIC—which doubles as your National Tax Number (NTN)

- Enter your business name, address, and activity

- Upload your bank certificate and other supporting documents

Once verified, your profile will show that you are a registered sole proprietor.

Mini Scenario: Nazia, who teaches English online, registers with FBR using her CNIC and uploads her bank certificate. Within days, she’s officially a registered business.

• Step 5: Register for Sales Tax (If Required)

If your business crosses the Rs. 7.5 million annual revenue threshold, or if your services are taxable (e.g., beauty salons, restaurants), register for sales tax via the same IRIS portal.

Sole Proprietorship – Business Activities Women Can Carry Out

A sole proprietorship allows you to engage in nearly any lawful business activity. You don’t need to form a company to sell, trade, or offer services.

Common business ideas for women include:

- Home bakeries or catering

- Online clothing or accessory stores

- Makeup studios and salons

- Freelancing (design, writing, coding)

- Daycare or tutoring services

Mini Scenario: Sadia starts a home-based content writing service. She registers as a sole proprietor and begins offering freelance writing to local clients.

Sole Proprietorship - Understanding Liability

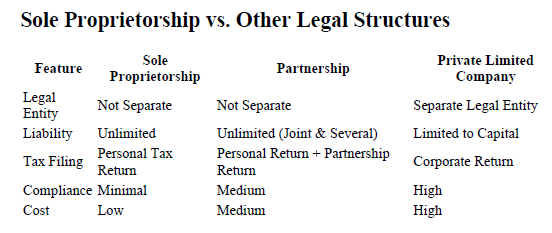

Sole Proprietorship vs. Other Legal Structures – At a Glance

Unlike a private limited company, a sole proprietorship is not a separate legal entity. This means:

- You’re personally responsible for debts

- Your personal assets (e.g., house, car) could be used to settle liabilities

While the setup is simple, be mindful of this risk as you grow.

Before choosing your business structure, it’s important to understand how liability, tax, and compliance differ across legal options available in Pakistan. Here's a simple comparison table:

Accessing Business Financing

Historically, sole proprietors—especially women—faced hurdles in accessing finance. But the situation has improved significantly with:

- The Secured Transaction Registry (STR) by SECP, which lets you pledge movable assets as loan collateral

- SBP’s Refinance Scheme for Women Entrepreneurs

- Dedicated products from banks like First Women Bank Ltd.

Mini Scenario: Farah registers her business as a sole proprietorship and uses her bakery’s inventory and equipment as collateral to obtain a microloan through the STR.

Ongoing Compliance

Once your business is registered:

- File your annual tax return by September 30 each year

- If sales tax registered, submit monthly returns

- Keep records of income, expenses, and bank transactions

- Update FBR if your business address or activity changes

Final Thoughts

Registering as a sole proprietor gives women in Pakistan a formal, legal footing to run and grow their businesses. It opens up avenues for financing, builds customer trust, and helps you comply with tax laws.

Whether you’re managing a passion project or planning to scale, a sole proprietorship is the first empowering step toward entrepreneurship. And when your business grows, you can always transition to a private limited company for more protection and scalability.

- Home

- Legal Structuure

- Sole Proprietorship