How to Raise Finance?

How to Raise Finance - Requirements

What are the requirements - 'How to Raise Finance'?

This is a question that comes to the mind when you get down to raising finance from a formal source.

Raising finance is a crucial step for business growth—whether to meet working capital needs, expand operations, invest in equipment, or enter new markets. But many entrepreneurs face confusion around the actual process and requirements. This guide breaks down the step-by-step method on how to raise finance from formal sources like banks or financial institutions, explains key financial documents, and offers mini scenarios to help you prepare a successful funding application.

How to Raise Finance - A Step-by-Step Overview

Step 1: Understand Your Financing Needs

Begin with a clear understanding of how much money you need, why you need it, and how you will repay it. This includes deciding:

- Amount required (e.g., PKR 2 million)

- Type of finance (e.g., term loan, working capital loan)

- Repayment period (e.g., 3 years)

- Security or collateral available

Example:

Saira, who owns a home-based textile business, needs PKR 2 million to scale her operations before the festive season. She plans to use the funds for raw material and staff expansion, with a projected repayment over 18 months.

Step 2: Prepare Key Financial Statements

Brief:

As you understand what you need in terms of the amount, repayment period, rate and type of finance; you need to proceed with planning the execution of your financing requirement. There are terminologies that bankers use which sound difficult but actually are quite simple if explained by competent experts.

To evaluate your application, lenders need a snapshot of your business’s financial health. You must prepare the following:

- Balance Sheet

- Income Statement

- Cash Flow Statement

Detailed:

1. Balance Sheet

In the Balance Sheet you have your Capital Structure i.e. all the Equity you put in plus the Liabilities you raised and these all should add up to give you the Assets you have created by all the money you have put in the business.

Displays what your business owns (assets) and owes (liabilities), including owner’s equity. It helps the bank assess your net worth and capital structure.

Tip: Ensure your liabilities and assets match; it demonstrates well-maintained records.

2. Income Statement (Profit & Loss)

In the Income Statement you have recorded all the Revenues you have earned and all the expenses you have made in running your business. The difference of the Revenues and Expenses will be your Net Profit if you made money or Net Loss if your expenses are more than your income.

It shows revenues, costs, and profit/loss over a period. It highlights whether your business is making money and how sustainable your model is.

Scenario: A retail shop shows consistent profit over the last two years—this builds the bank’s confidence in repayment ability.

3. Cash Flow Statement

The Cash Flow Statement is the movement of cash in two periods of time and is made using both the Income Statement and the changes in Balance Sheet accounts. It gives you a clear picture of how much money or Cash actually came into or went out of your business.

Details the actual cash moving in and out of your business, not just what is "earned on paper." Banks prioritize this to ensure you can meet monthly instalments.

Note: Prepare monthly or quarterly cash flows for at least the past year.

Step 3: Build a Business Profile

When you approach a financial institution for financing you should be very clear about your Business Model, your supply chain and your client base. Your marketing strategies and the period for which you have to hold inventories and in what quantities.

Your business model, supply chain, and market presence must be presented clearly:

- Nature of products or services

- Customer segments and channels

- Vendor and buyer lists (include 2-3 references)

- Inventory cycle and storage methods

- Sales and marketing materials, photos of stalls/exhibits

Example:

Amna, a furniture manufacturer, included a brochure, workshop photos, and

reference letters from 2 long-standing corporate clients to support her application.

Step 4: Draft a Finance Request Letter

Write a formal letter addressed to your bank or financing institution, including:

- Amount requested

- Purpose of financing

- Type of collateral offered

- Request for a meeting

You may also need to fill out the bank’s Loan Application Form, available online in English and Urdu.

Step 5: Understand Security/Collateral Requirements

Brief:

Banks require collateral to secure the loan, also known as secured lending. Coming on to types of security here are the common types:

- Pledge of goods

- Hypothecation of inventory or vehicles

- Charge on receivables or equipment

- Movable Assets Registration under SECP’s Secured Transaction Registry (STR)

Update: Under the Financial Institutions (Secured Transactions) Act 2016, movable assets—such as stock, accounts receivable, and vehicles—can now be used as collateral even by non-corporate entities, greatly supporting SMEs.

Detailed:

The security required to obtain any financing is also termed as 'collateral'. This is only a term used by financial institutions which should not confuse you as it means the same as security.

These processes are the same whether you have a sole proprietorship, partnership or a company. However, in case of charge registration where assets are hypothecated in favor of the bank/FI it has to be a company.

To deal with this long standing issue of charge creation a Secured Transaction Registry for movable assets has been created by the Securities and Exchange Commission of Pakistan (SECP) pursuant to the Financial Institutions (Secured Transactions) Act 2016. It will be used to register security charges created by entities other than companies thereby supporting the SME sector to provide better security structures to the financial institutions. Moveable assets include agricultural produce, stocks, receivables, intellectual property, vehicles etc.

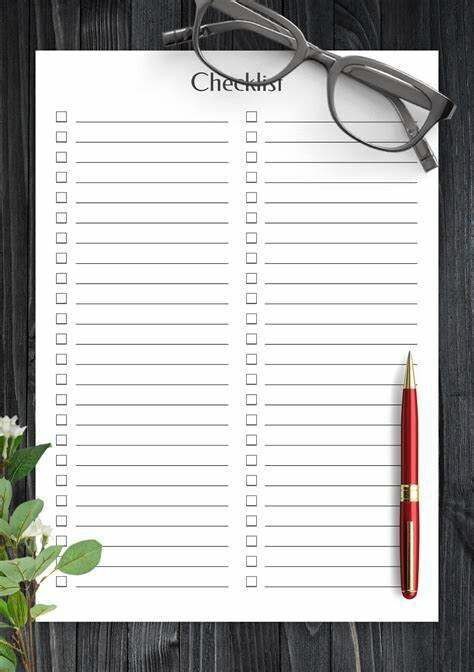

Step 6: Complete the Documentation Checklist

Here is a general list of documents required by most banks:

✅ Business profile (products, size, staff, etc.)

✅ Loan application form (filled and signed)

✅CNIC copies of proprietor/partners/directors

✅ Signature verification (certified by your bank)

✅ Bank certificate for sole proprietors

✅ Last 6 months’ bank statements

✅ Income Tax Returns (preferably for 2 years)

✅ Management or Audited Accounts (last 3 years)

✅ Sales & Expense Ledgers (last 3 months)

✅ Revenue breakup with receivables ageing

✅ List and valuation of assets to be hypothecated

✅ Business projections for 3-5 years (especially for new businesses)

✅ Borrower’s Basic Fact Sheet (BBFS) – provided by the bank

Note: MizLink Pakistan can assist in compiling this information to make your application ‘bankable.’

Final Thoughts: Making Yourself Bankable

Being “bankable” means having well-documented, transparent, and verifiable business records. It shows professionalism and builds lender confidence.

Start small: apply for financing in a manageable amount, build your track record, and grow your credibility with financial institutions.

Let MizLink Pakistan help you navigate the process with confidence. We work with our members to prepare documentation, understand regulatory frameworks, and connect with the right lending channels.

If you’re ready to raise finance, begin today by reviewing your books and business model—because opportunity often comes to those prepared to take it.

- Home

- Raising Finance

- How To Raise Finance